andalisolutions / anaf-php

Description

Requires

- php: ^8.2.0

- ext-iconv: *

- ext-libxml: *

- ext-simplexml: *

- guzzlehttp/guzzle: ^7.5.0

- php-http/discovery: ^1.19

Requires (Dev)

- laravel/pint: ^1.24

- mockery/mockery: ^1.6

- nunomaduro/collision: ^8.0.0

- pestphp/pest: ^3.80.0

- pestphp/pest-plugin-type-coverage: ^3.6

- phpstan/phpstan: ^2.1

- rector/rector: ^2.1.0

- symfony/var-dumper: ^6.2.2

- dev-main

- v0.8.1

- v0.8.0

- v0.7.7

- v0.7.6

- v0.7.5

- v0.7.4

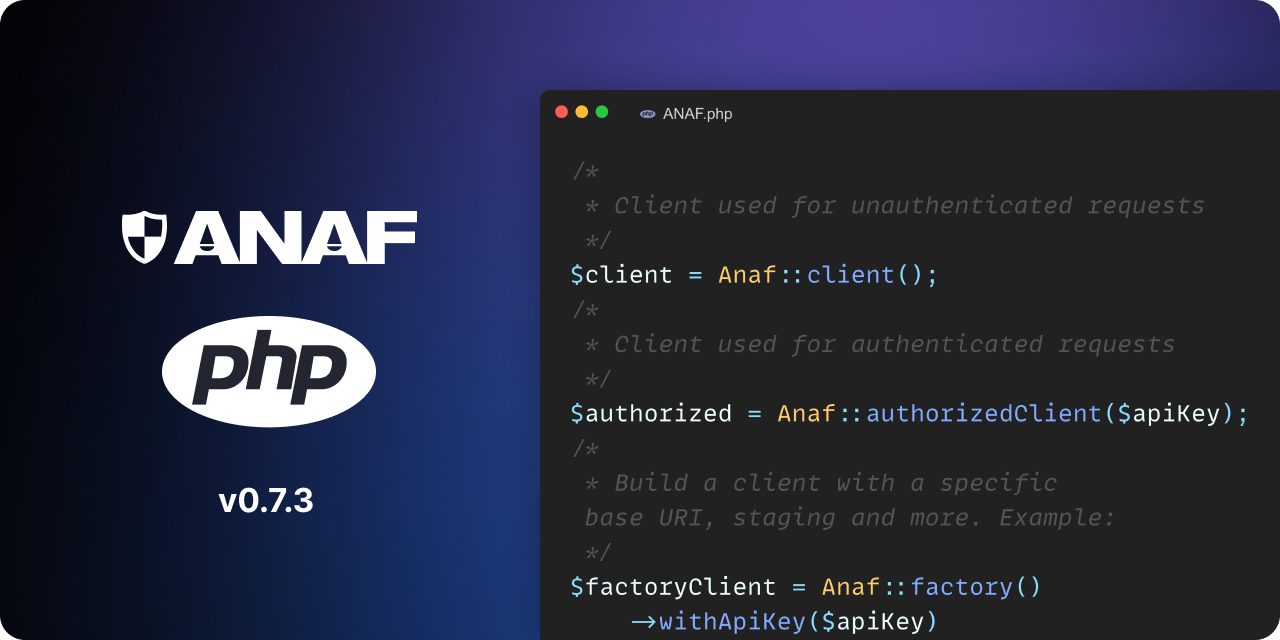

- v0.7.3

- v0.7.2

- 0.7.1

- v0.7.0

- v0.6.1

- v0.6.0

- v0.5.0

- v0.4.1

- v0.4.0

- v0.3.0

- v0.2.0

- v0.1.0

- dev-dependabot/github_actions/dependabot/fetch-metadata-2.5.0

- dev-dependabot/github_actions/actions/cache-5

- dev-dependabot/github_actions/actions/checkout-6

- dev-updates-04-09-2024

- dev-fix

- dev-move-request-to-classes

This package is auto-updated.

Last update: 2026-02-05 19:09:20 UTC

README

ANAF PHP is a PHP API client that allows you to interact with the ANAF Web Services.

Get Started

Requires PHP 8.2+

First, install ANAF via the Composer package manager:

composer require andalisolutions/anaf-php

Then, you can create ANAF client in two ways:

/* * Client used for unauthenticated requests */ $client = Anaf::client(); /* * Client used for authenticated requests */ $authorizedClient = Anaf::authorizedClient($apiKey); /* * Build a client with a specific base URI, staging and more. Example: */ $factoryClient = Anaf::factory() ->withApiKey($apiKey) ->staging() ->withBaseUri('https://webservicesp.anaf.ro') ->make();

You can obtain API key using oauth2-anaf package.

TODO

- Obtaining public information in the financial statements/annual accounting reports related to economic agents. (Docs)

- Get info about companies using

TAX IDENTIFICATION NUMBER(CUI/Vat Number). (Docs) - Get info about taxpayers who are registered in the Register of farmers who apply the special regime (Docs)

- Get info about taxpayers who are registered in the Register of religious entities/units (Docs)

- Accessing the functionalities offered by the SPV (Docs)

- The national system regarding the electronic invoice RO e-Factura (Docs)

- The integrated electronic system RO e-Transport (Docs)

Usage

Balance Sheet Resource

Get public information in the financial statements/annual accounting reports related to economic agents

$balanceSheet = $client()->balanceSheet()->create([ 'cui' => '12345678', 'an' => 2019, ]); $balanceSheet->year; $balanceSheet->tax_identification_number; $balanceSheet->company_name; $balanceSheet->activity_code; $balanceSheet->activity_name; $balanceSheet->indicators; // array $balanceSheet->indicators['AVERAGE_NUMBER_OF_EMPLOYEES']->value; $balanceSheet->indicators['NET_LOSS']->value; $balanceSheet->indicators['NET_PROFIT']->value; $balanceSheet->indicators['GROSS_LOSS']->value; $balanceSheet->indicators['GROSS_PROFIT']->value; $balanceSheet->indicators['TOTAL_EXPENSES']->value; $balanceSheet->indicators['TOTAL_INCOME']->value; $balanceSheet->indicators['NET_TURNOVER']->value; $balanceSheet->indicators['HERITAGE_OF_THE_KINGDOM']->value; $balanceSheet->indicators['PAID_SUBSCRIBED_CAPITAL']->value; $balanceSheet->indicators['CAPITAL_TOTAL']->value; $balanceSheet->indicators['PROVISIONS']->value; $balanceSheet->indicators['ADVANCE_INCOME']->value; $balanceSheet->indicators['LIABILITIES']->value; $balanceSheet->indicators['PREPAYMENTS']->value; $balanceSheet->indicators['HOME_AND_BANK_ACCOUNTS']->value; $balanceSheet->indicators['DEBT']->value; $balanceSheet->indicators['INVENTORIES']->value; $balanceSheet->indicators['CURRENT_ASSETS']->value; $balanceSheet->indicators['FIXED_ASSETS']->value; $balanceSheet->toArray(); // ['year' => '', 'tax_identification_number' => '', 'company_name' => '' ...]

For balance sheets, the indicators may vary depending on the type of company, as specified by ANAF. I recommend you to use var_dump to observe the type of indicators. The vast majority of companies have the indicators from the example above

Info Resource

Get info about the company or multiple companies.

$companyInfo = $client->info()->create([ [ 'cui' => '12345678', 'data' => '2021-01-01', ], [ 'cui' => '222222', 'data' => '2021-01-01', ] ]); /* * If you send one array, for one company, you will receive a CreateResponse object with the structure below. * If you send multiple arrays, for multiple companies, you will receive a CreateResponses object with an array * with CreateResponse objects. */ $companyInfo->generalData; /* Accessible information in general data */ $companyInfo->generalData->companyName; $companyInfo->generalData->address; $companyInfo->generalData->registrationNumber; $companyInfo->generalData->phone; $companyInfo->generalData->fax; $companyInfo->generalData->postalCode; $companyInfo->generalData->document; $companyInfo->generalData->registrationStatus; $companyInfo->generalData->registrationDate; $companyInfo->generalData->activityCode; $companyInfo->generalData->bankAccount; $companyInfo->generalData->roInvoiceStatus; $companyInfo->generalData->authorityName; $companyInfo->generalData->formOfOwnership; $companyInfo->generalData->organizationalForm; $companyInfo->generalData->legalForm; $companyInfo->vatRegistration; /* Accessible information in vat registration */ $companyInfo->vatRegistration->status; //vatPeriods is an array from ANAF v8 $companyInfo->vatRegistration->vatPeriods[0]->startDate $companyInfo->vatRegistration->vatPeriods[0]->stopDate; $companyInfo->vatRegistration->vatPeriods[0]->stopEffectiveDate; $companyInfo->vatRegistration->vatPeriods[0]->message; $companyInfo->vatAtCheckout; /* Accessible information in vat at checkout */ $companyInfo->vatAtCheckout->startDate; $companyInfo->vatAtCheckout->stopDate; $companyInfo->vatAtCheckout->updateDate; $companyInfo->vatAtCheckout->publishDate; $companyInfo->vatAtCheckout->updatedType; $companyInfo->vatAtCheckout->status; $companyInfo->inactiveState; /* Accessible information in inactive state */ $companyInfo->inactiveState->inactivationDate; $companyInfo->inactiveState->reactivationDate; $companyInfo->inactiveState->publishDate; $companyInfo->inactiveState->deletionDate; $companyInfo->inactiveState->status; $companyInfo->splitVat; /* Accessible information in split tva */ $companyInfo->splitVat->startDate; $companyInfo->splitVat->stopDate; $companyInfo->splitVat->status; $companyInfo->hqAddress; /* Accessible information in hq address */ $companyInfo->hqAddress->street; $companyInfo->hqAddress->no; $companyInfo->hqAddress->city; $companyInfo->hqAddress->cityCode; $companyInfo->hqAddress->county; $companyInfo->hqAddress->countyCode; $companyInfo->hqAddress->countyShort; $companyInfo->hqAddress->country; $companyInfo->hqAddress->details; $companyInfo->hqAddress->postalCode; $companyInfo->fiscalAddress; /* Accessible information in fiscal address */ $companyInfo->fiscalAddress->street; $companyInfo->fiscalAddress->no; $companyInfo->fiscalAddress->city; $companyInfo->fiscalAddress->cityCode; $companyInfo->fiscalAddress->county; $companyInfo->fiscalAddress->countyCode; $companyInfo->fiscalAddress->countyShort; $companyInfo->fiscalAddress->country; $companyInfo->fiscalAddress->details; $companyInfo->fiscalAddress->postalCode; // You can use all resources as array $companyInfo->toArray(); // ["general_data" => ["tax_identification_number" => '', "company_name" => ''...]..] // or $companyInfo->generalData->toArray(); // ['tax_identification_number' => '', 'company_name' => ''...]

Ngo Resource

Checking NGO taxpayers who are registered in the Register of religious entities/units

$entityInfo = $client->ngo()->create([ [ 'cui' => '12345678', 'data' => '2021-01-01', ] ]); $entityInfo->taxIdentificationNumber; $entityInfo->searchDate; $entityInfo->entityName; $entityInfo->address; $entityInfo->phone; $entityInfo->postalCode; $entityInfo->document; $entityInfo->registrationStatus; $entityInfo->startDate; $entityInfo->endDate; $entityInfo->status; // You can use all resources as array $entityInfo->toArray(); // ["tax_identification_number" => '', "entity_name" => ''...]

eFactura Resource

Upload Resource

Upload an XML (eFactura) file to the SPV

TODO: improve error handling

$upload = $authorizedClient->efactura()->upload( xml_path: $pathToXmlFile, taxIdentificationNumber: '12345678', //standard: UploadStandard::UBL, // default value is UBL //extern: false, // default value is false //selfInvoice: false, // default value is false, //b2c: false, // default value is false ); $upload->responseDate, // 202401011640 $upload->executionStatus, $upload->uploadIndex,

Status Resource

TODO: implement status from here

Messages Resource

TODO: implement paginated messages from here

Get the list of available messages

$spvMessages = $authorizedClient->efactura()->messages([ 'zile' => 30, // between 1 and 60 'cif' => '12345678', ]); $spvMessages->messages; // array $spvMessages->serial; $spvMessages->taxIdentificationNumbers; $spvMessages->title; $message = $spvMessages->messages[0]; $message->creationDate, $message->taxIdentificationNumber, $message->solicitationId, $message->details, $message->type, $message->id,

Download - eFactura XML Resource

Get a file from the SPV identified by the id received from the messages endpoint

$file = $authorizedClient->efactura()->download([ 'id' => '12345678', ]); $file->getContent(); // string - You can save/download the content to a file

Validate Resource

Validate the XML

/* * $xmlStandard can be one of the following: 'FACT1', 'FCN'. * The default value is 'FACT1' */ $response = $client->efactura()->validateXml($path_to_xml, $xmlStandard); $response->isValid(); //bool, you can proceed accordingly $response->status; //string 'ok' or 'nok' $response->messages; //array of messages, empty if validation successful $response->toArray(); //Examples $valid = [ 'stare' => 'ok', 'trace_id' => '....', ]; $invalid = [ 'stare' => 'nok', 'Messages' => [ [ 'message' => "Fisierul transmis nu este valid.....", ] ], 'trace_id' => '....', ];

XmlToPdf Resource

Convert XML eFactura to PDF. For this endpoint you need to use unauthenticated client

/* * $xmlStandard can be one of the following: 'FACT1', 'FCN'. * The default value is 'FACT1' */ $file = $client->efactura()->xmlToPdf($pathToXmlFile, $xmlStandard); $file->getContent(); // string - You can save the pdf content to a file

ANAF PHP is an open-sourced software licensed under the MIT license.