larsbadke / portfolio-selector

Portfolio-Selector is a PHP library that helps you to optimize your stock portfolio.

Installs: 23

Dependents: 0

Suggesters: 0

Security: 0

Stars: 1

Watchers: 1

Forks: 1

Open Issues: 0

pkg:composer/larsbadke/portfolio-selector

Requires

- php: ^5.3.3|^7.0

Requires (Dev)

- phpunit/phpunit: ~4.0

This package is not auto-updated.

Last update: 2026-02-15 03:41:24 UTC

README

Portfolio-Selector is a PHP library that helps you to optimize your stock portfolio.

Portfolio-Selector requires PHP >= 5.3.3.

Table of Contents

Installation

composer require larsbadke/portfolio-selector

Basic Usage

First create some stock objects and submit performances to them.

<?php // Create Apple stock object and set performances in percent. $apple = new Stock('Apple'); $apple->setPerformances([0, 3, 0, 3]); // Create Google stock object. $google = new Stock('Google'); $google->setPerformances([0, 3, 0, 3]); // Create a new portfolio instance and add your stocks to it $portfolio = new Portfolio(); $portfolio->add($apple); $portfolio->add($google);

Now you have access to all typical key figures.

<?php // Get the expectation value of your portfolio $portfolio->expectation(); // Get the variance of your portfolio $portfolio->variance();

To optimize your portfolio just create a Selector instance $selector = new Selector($portfolio) and run $selector->run().

<?php $selector = new Selector($portfolio); $selector->run();

Full example

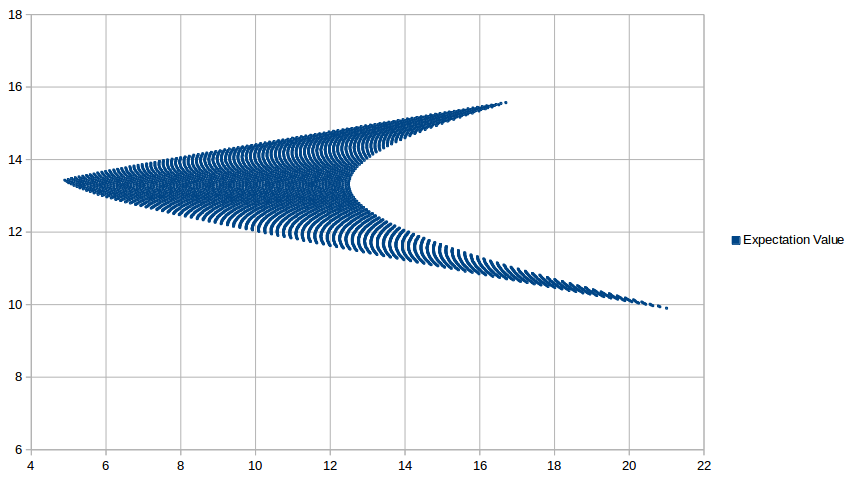

<?php // create portfolio $portfolio = new Portfolio(); // create stock with performances $intel = new Stock('Intel'); $intel->setPerformances([38.4, -11.6, 2.9]); $nike = new Stock('Nike'); $nike->setPerformances([20.2, 33.3, -6.8]); $visa = new Stock('Visa'); $visa->setPerformances([18.2, 15.4, 6.7]); // add stocks to portfolio $portfolio->add($intel); $portfolio->add($nike); $portfolio->add($visa); // create portfolio selector $selector = new Selector($portfolio); // run portfolio selection $selector->setInterval(1); $selector->run(); foreach ($selector->results() as $result) { $variance = round($result['variance'] * 100, 2); $expectation = round($result['expectation'] * 100, 2); echo "{$variance};{$expectation}<br>"; } // 4.9;13.43 // 4.99;13.45 // 5.08;13.48 // 5.18;13.5 // 5.28;13.52 // 5.38;13.54 // 5.48;13.56 // 5.58;13.58 // 5.68;13.6 // 5.78;13.63 // 5.89;13.65 // 5.99;13.67 // 6.1;13.69 // 6.21;13.71 // 6.31;13.73 // 6.42;13.75 // 6.53;13.77 // 6.64;13.8 // 6.75;13.82 // 6.86;13.84 // 6.97;13.86 // 7.09;13.88 // 7.2;13.9 // 7.31;13.92 // 7.43;13.95 // 7.54;13.97 // 7.65;13.99 // 7.77;14.01 // 7.89;14.03 // 8;14.05 // 8.12;14.07 // ...

####Performance-Risk Diagram (5051 Allocations)

####Get allocation with lowest risk

<?php $portfolio = new Portfolio(); $apple = new Stock('apple'); $google = new Stock('google'); $apple->setPerformances([0, 3, 0, 3]); $google->setPerformances([6, 0, 6, 0]); $portfolio->add($apple); $portfolio->add($google); $selector = new Selector($portfolio); $selector->setInterval(10); $selector->run(); print_r($selector->lowestRisk()); // returns [ { expectation: "0.0195", variance: "0.0015", allocation: { apple: "0.7", google: "0.3" } } ]

Attention

A high amount of stocks or a low allocation interval can increase the execution time enormously. If you want to optimize a portfolio with many stocks, just use a higher allocation interval.

More

More about portfolio selection: Wikipedia

License

Portfolio-Selector is released under the MIT Licence. See the bundled LICENSE file for details.